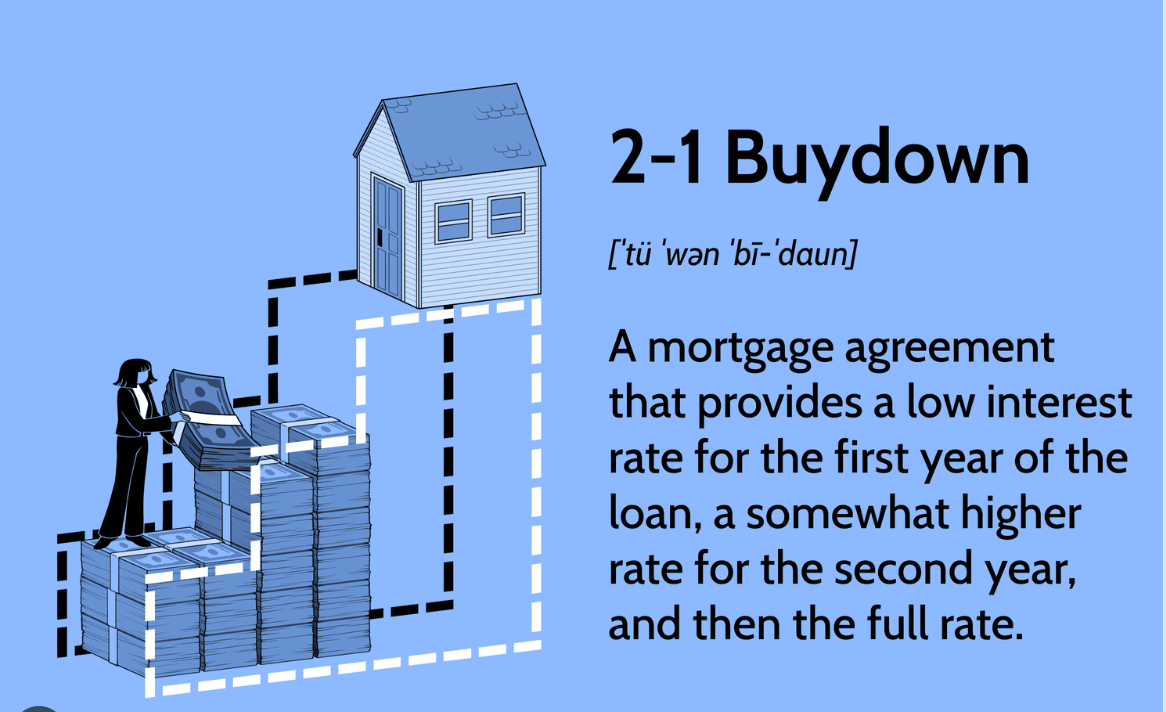

Understanding 2-1 Buydowns: A Smart Move for First-Time Homebuyers!

In today’s higher-interest-rate environment, many first-time homebuyers are turning to 2-1 buydowns as a creative way to ease into homeownership.

A 2-1 buydown is a type of temporary mortgage rate reduction that lowers your interest rate by 2% in the first year and 1% in the second year—before returning to your full rate in year three. For example, if your permanent rate is 6.5%, you’d pay 4.5% in year one, 5.5% in year two, and 6.5% after that.

The difference in interest is often paid upfront—usually by the seller, builder, or lender as a concession—helping you enjoy lower monthly payments during your first two years of homeownership.

🏠 Why It’s Great for First-Time Buyers

-

Lower initial payments make budgeting easier as you adjust to new expenses.

-

More purchasing power—you might qualify for a slightly higher-priced home.

-

Flexibility—if rates drop, you can refinance before the rate resets.

⚠️ What to Watch For

-

Payments will increase in year three, so plan your budget accordingly.

-

Not all lenders or sellers offer buydowns, so discuss options early.

✨ Bottom Line

A 2-1 buydown can be a powerful tool to make your first home more affordable upfront—especially in a market where creative financing can make all the difference.

DM me if you’d like to explore homes that qualify for seller-paid buydowns in San Diego County.

Categories

Recent Posts