Q4 2025 San Diego Real Estate Trends — and What’s Ahead for Q1 2026

Q4 2025 San Diego Real Estate Trends — and What’s Ahead for Q1 2026

Market pulse (Q4 so far):

-

Inventory has inched up from late summer levels, giving buyers a bit more choice, and days on market have lengthened versus last year. Detached median has hovered around ~$1.02M–$1.08M recently, while attached homes sit in the high-$600Ks. sdar.stats.10kresearch.com+1

-

Citywide, late-summer data showed prices essentially flat to slightly lower year over year, with homes taking longer to sell than in 2024. Redfin

-

Mortgage rates are still in the mid-6s as of early October, after ticking up for a second week—keeping affordability front-of-mind. AP News

What’s driving the shift:

-

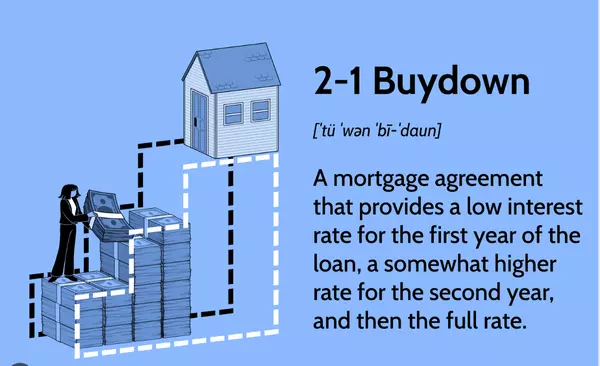

Rates & affordability: Payments at today’s rates continue to sideline some buyers; cash remains influential across price points. AP News+1

-

More listings: Compared with midsummer, both detached and attached segments show higher inventory, easing the multiple-offer pressure we saw earlier this year. sdar.stats.10kresearch.com+1

Segment snapshots:

-

Luxury ($1.5M+): Well-priced homes still move, but buyers are value-conscious and expect turnkey. DOM has expanded vs. last year; presentation and pricing strategy matter more than ever. (Local trend context: longer DOM citywide vs. 2024.) Redfin

-

Move-up & first-time: Slightly more choice + seasonal Q4 motivation = opportunities, especially for buyers comfortable “marrying the house, dating the rate.” (Rates remain mid-6s now; forecasts suggest relief into 2026.) AP News+1

-

Condos/townhomes: Attached median is holding better than detached on a year-over-year basis in recent SDAR reads—an attractive entry for payment-sensitive buyers.

Categories

Recent Posts